Streamlined application process and management platform that simplifies how you access your SR&ED tax credits.

Main Content

SR&ED Financing for Innovators

Easly's Capital‑as‑a‑Service platform is a strategic, non-dilutive alternative to fund your growth. Accelerate your SR&ED Refund with Easly Advances.

Get Started

Easy as 1-2-3

Tax credit financing has never been easier or faster.

We know your time is valuable. Our Capital-as-a-Service platform is designed to get you funded fast. Easly Advances turn your distant, lump-sum disbursements into growth capital you can access today.

2) Setup Easly Account

Our agreements are made for people, not lawyers, so they're easy to understand.

3) Get Funded

Start receiving funds backed by your earned SR&ED tax credits!

Fuel Your Growth Now

Our results as Canada’s premier SR&ED financing platform:

$300+ million

Capital Deployed

500+

Companies Supported

1000+

Advances Issued

Read what our customers have to say

“Before working with Easly we had explored other SR&ED financing providers. They seemed to make things very, very complicated. When we learned about Easly’s platform we realized it was just much easier. It took a week or so to gather our documentation. And a week or two later we were funded. It was very seamless.”

Charles-Étienne Simard · CoFounder and COO, Leav

“If you’re unsure about your cash flow, Easly Advances are a beautiful token to have in your back pocket. They can really take a lot of stress off the founders and the executive team to know they have access to cash flow to bridge cash flow gaps.”

Chris Cassin · CEO, Zero Point Cryogenics

“Easly responded quickly to our enquiry and provided valuable information and guidance on their process. There weren’t any hidden costs; it was all open and clear.”

Nate Kasten · Founder, Grey & Ivy

“Working with Easly was a very easy decision for us because of their responsiveness, turnaround time, terms of financing, and reasonable cost of capital. Most importantly, they understood what we were doing and were responsive to our needs.”

Lennie Ryer · CFO, Reaction Dynamics

“Easly’s not scared of start-ups. You can’t pick between keeping day-to-day operations going or buying inventory. You need to do both. Easly enabled us to continue operations and set our sights firmly on global markets.”

Carlyn Loncaric · Founder & CEO, VodaSafe

“We needed to raise some capital. It was a tough time to raise for a young startup. It’s just way more expensive and harder to raise a proper round that makes sense at the end of the day. Having that cashflow from Easly at a very affordable price backed by something we knew we were going to receive from the CRA just made sense.”

Olivier Roy · CoFounder and CEO, Leav

“Easly provided a fast and easy solution for our financing needs. Quarterly Easly Advances are working for us.”

Patricia Macleod · CEO & Cofounder, HiringBranch

“Easly has been very good to us. They give us financial options at a rate and frequency that small technology companies absolutely need. I appreciate the online process a lot – being able to just upload financial documents is really, really convenient. We now use Easly Advances as part of our financial model. It’s not about survival; it’s about strategy.”

Dominique Kwong · COO & Cofounder, Damon Motorcycles

“The financing that Easly offers is very cost-effective from a pure opportunity cost of capital point of view. It’s a very low-cost way for a small tech company to grow and sustain operations.”

Hassaan Ahmad · CFO, WTFast

“I’ve spoken to many companies that promised quick turnarounds for approvals & funding. All of them either missed that target by weeks or came back with a ridiculous offer we could never accept. Easly was true to their word and responded quickly with a competitive offer that met our needs. The whole process was refreshing and surprisingly streamlined!”

Jaed Khan · Former Founder & CEO, Foodmaestro (Acquired by Walmart)

“SR&ED is a great program, but it can take a long time to get the funds. We wanted an option that would make things more reliable so that we could count on funds coming in when expected. Easly does just that for us.”

Caitlin Krapf · VP, HR & Organizational Development, Province Brands

“Easly is a customer-focused organization. The process was efficient and focused on the parts that matter, as opposed to the red tape, and delivered above and beyond our expectations. They proved to us that they are the best source of R&D financing on the market.”

Sean McCann · President, MMIST Inc.

“Easly played a critical role in our ability to keep the company’s finances healthy. Their funds helped bridge us from survival to product-market fit, and it’s difficult to envision us having the success we’re seeing today without Easly.”

Martin Kratky-Katz · Cofounder & CEO, Blockthrough

“We initially went with Easly because they had the most competitive rates by far. Even more compelling, though, was the transparent and streamlined process that just made sense. The communication was smooth, and I always felt certain about the outcome. I’d recommend them to anyone planning to file for an SR&ED refund.”

Tristan Lehari · Founder & CEO, TritonWear

What are Easly Advances?

An Easly Advance is our form of investment tax credit financing, provided through our Capital-as-a-Service platform. You’ll receive the accrued portion of your SR&ED refund on-demand. Easly Advances can range from $50,000 to $25,000,000.

SR&ED Financing

The Canada Revenue Agency (CRA) awards these tax credits to over 20,000 claimants yearly, totalling more than $4 billion in 2021. SR&ED claims are made annually by submitting Form T661 with your corporate tax return. That means your business is spending on eligible work all year but only being reimbursed in one annual lump sum.

Once you submit Form T661, the CRA will review it and determine if your business is eligible for a refund. Processing times with the CRA can take months, further restricting cash flow.

At Easly, we understand your business can’t afford to play the waiting game. Leverage those accrued credits before you file to access non-dilutive capital on-demand with Easly Advances. Keep control of your business by giving your cash flow a boost without giving up equity. We also finance other government tax incentives. Connect with us to learn more.

Capital-as-a-Service

Our non-dilutive financing addresses the cash management needs of Canada’s innovative companies.

.png)

.png)

Accelerated funding timeline so you can access capital on your schedule.

.png)

Accessible any time throughout the year so you can better manage cash flow - access capital before you file your claims.

.png)

Competitive pricing makes Easly Advances an affordable and integral part of a diverse capital stack.

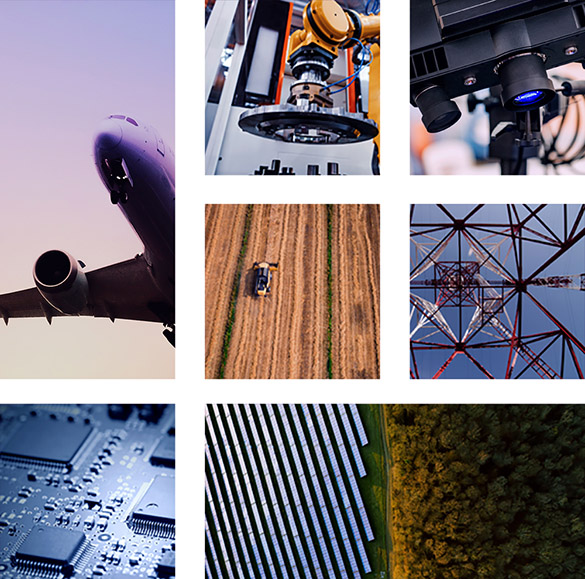

Powering Innovation Across Canada

The SR&ED tax incentive program is an invaluable asset to companies operating in the country. It helps ease the burden of investing in projects that may have uncertain returns but are essential to fostering innovation. We complement the SR&ED program, making the refund more accessible to the companies innovating today and building tomorrow.

Easly's Innovation Spotlight

-

Piranha Games

Vancouver, British Columbia

The key asset to making hit video games is talent. Learn how Piranha Games leveraged their team’s talent to launch their recent title, MechWarrior 5.

“In the video game business, it’s all about your employees and the talent those employees have.”

– Chris Pauwels, Chief Operations Officer, Piranha Games

-

MailChannels

Vancouver, British Columbia

MailChannels set out to make a difference in the email community. See how strategic pivoting helped them accomplish that in this edition of the series.

“It was like blowing on the embers of a fire. We just built from one customer win to another.”

– Ken Simpson, CEO, MailChannels

-

Yocale

Vancouver, British Columbia

Along the journey to build a successful business, problems inevitably arise. See how the team at Yocale hunts those problems down to find the right solutions in this edition of Easly’s Innovation Spotlight.

“You have to go and find those problems and get to the root cause. That’s where the differentiation comes in.”

– Arash D. Asli, Co-Founder and CEO, Yocale

News & Announcements

CRA Strike: Your SR&ED Refund May Be Delayed

CRA Strike: Your SR&ED Refund May Be DelayedIt’s official, the Public Service Alliance of Canada, which represents many employees working for the Canada Revenue Agency (CRA), is…

Read More » Easly and ventureLAB Announce New Partnership to Drive Innovation in Canada

Easly and ventureLAB Announce New Partnership to Drive Innovation in CanadaToday, Easly, a leading Capital-as-a-Service financing platform, and ventureLAB, a global founder community for hardware technology and enterprise software, announced…

Read More » Accelerator Centre Partners with Easly to Further Support the Canadian Innovation Economy

Accelerator Centre Partners with Easly to Further Support the Canadian Innovation EconomyKitchener-Waterloo-based Accelerator Centre (AC) has partnered with Easly to support the AC’s members as they bring their innovative ideas to…

Read More »